Introduction

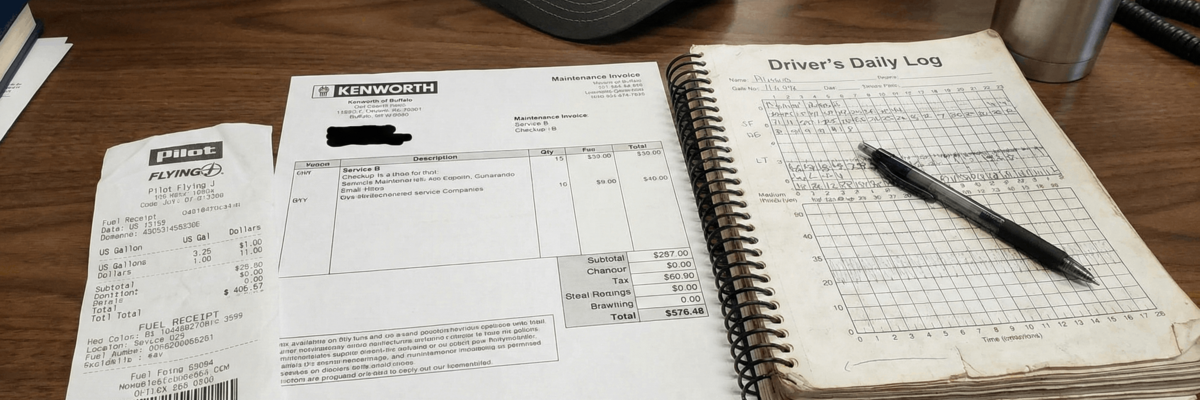

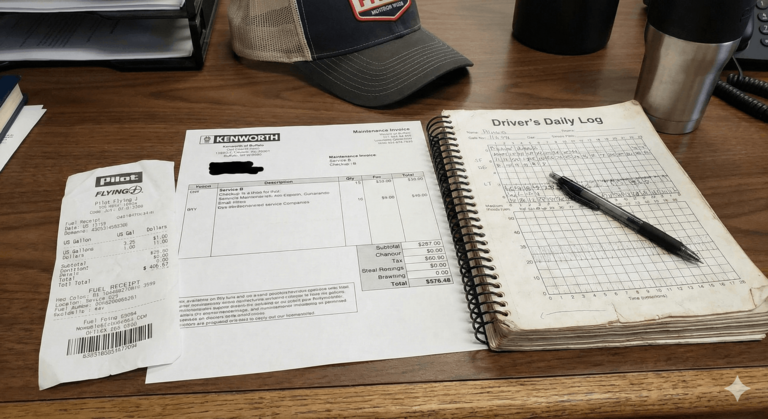

How much money is your fleet losing because expenses aren't tracked properly? The average owner-operator misses $3,000-$5,000 in tax deductions each year, and small fleets waste thousands on emergency repairs that could have been prevented. A driver log book helps truckers stay organized and manage expenses more effectively. By tracking fuel purchases, oil changes, tire replacements, and repairs and service intervals, drivers can identify cost patterns and areas where spending can be reduced.

But here's the problem: Paper log books get lost, receipts fade, and manual calculations are error-prone. Accurate expense records support tax reporting, reimbursements, maintenance planning, and audit preparedness—but only if they're actually accurate. When combined with modern DVIR software, driver log books become even more powerful tools for fleet management and compliance, automatically capturing every expense and generating reports that satisfy both IRS and DOT requirements.

This article explains how driver log books help track expenses, manage maintenance records, ensure compliance, and improve overall fleet operations.

How One Owner-Operator Lost $12,000 in Tax Deductions (And How to Avoid It)

Last tax season, we helped an owner-operator in Oregon who was panicking. He'd lost his receipt folder—the one with all his fuel, maintenance, and repair receipts from the past year. His accountant told him he couldn't deduct $12,000 in expenses without receipts. That meant paying an extra $3,000 in taxes he couldn't afford.

We've seen this story play out dozens of times. Here's what happens when expense tracking goes wrong:

- The Receipt Graveyard: Receipts get stuffed in glove boxes, lost under seats, or thrown away. One driver showed us a ziplock bag full of faded, unreadable receipts from the past 6 months. The IRS won't accept "I think this was for fuel" as a deduction. Digital log books let you snap a photo of the receipt right when you pay—it's stored forever, and it's searchable.

- The "I'll Write It Down Later" Problem: Drivers promise to log expenses at the end of the day, but they forget. By the time tax season rolls around, they're guessing. "I probably spent about $8,000 on fuel last year?" The IRS doesn't accept guesses. Digital log books prompt you to enter expenses immediately, with GPS location and timestamp.

- The Maintenance Pattern Blind Spot: A fleet manager in Wisconsin noticed one truck kept needing brake repairs. When he finally looked at the expense log, he saw the same truck had brake work done 4 times in 6 months—but no one had connected the dots. If they'd tracked it properly, they would have caught the root cause (a faulty brake controller) after the second repair, saving $6,000 in unnecessary brake jobs.

- The Reimbursement Argument: A driver in Alberta claimed he spent $400 on a tire repair and wanted reimbursement. The fleet manager said the company policy only covers repairs under $200. They argued for weeks. With digital expense tracking, the policy is built in—the system automatically flags expenses that need approval, and everything is documented with photos and receipts.

- The Audit Nightmare: When the IRS audited a small fleet in Texas, they asked for expense records from 18 months ago. The fleet manager spent 3 days digging through filing cabinets, and still couldn't find everything. The IRS disallowed $8,000 in deductions. With digital log books, that same fleet manager could have generated a complete expense report in 2 minutes.

What We Did for That Oregon Owner-Operator: We helped him set up a digital log book system. Now, every time he fills up, gets an oil change, or buys a part, he snaps a photo of the receipt and enters it in the app. At tax time, his accountant gets a complete, categorized report with all receipts attached. Last year, he saved $4,200 in taxes—and it took him 5 minutes to generate the report.

Tracking Expenses with a Driver Log Book

A driver log book helps truckers stay organized and manage expenses more effectively. By tracking:

- Fuel purchases

- Oil changes

- Tire replacements

- Repairs and service intervals

Drivers can identify cost patterns and areas where spending can be reduced.

Accurate expense records also support:

- Tax reporting

- Reimbursements

- Maintenance planning

- Audit preparedness

Maintenance Records and Vehicle Safety

Maintenance documentation is closely tied to driver log books. Logging inspections and repairs helps ensure:

- Vehicles are roadworthy

- Defects are addressed promptly

- Maintenance schedules are followed

- Inspection histories are available during audits

Missing or incomplete maintenance records are a common reason for DOT violations and vehicle out-of-service orders.

Driver Log Books and Pre-Trip Inspections

Pre-trip inspections are required before operating a commercial vehicle. Recording these inspections in a log book ensures:

- Legal compliance

- Early detection of defects

- Proof during inspections and audits

When paired with digital DVIR software, inspection records become searchable, timestamped, and audit-ready.

Digital Driver Log Books vs Paper Logs

Modern fleets are increasingly moving from paper log books to digital solutions. Here's a comparison:

| Paper Log Books | Digital Log Books |

|---|---|

| Easy to lose | Secure cloud storage |

| Manual calculations | Automated tracking |

| Hard to audit | Instant reports |

| No integration | DVIR & maintenance integration |

Digital solutions reduce errors and provide real-time visibility into fleet operations.

How Driver Log Books Improve Compliance in the US & Canada

Regulators in the US and Canada require fleets to maintain accurate records. Driver log books help demonstrate:

- Inspection compliance

- Maintenance diligence

- Expense transparency

- Operational responsibility

Digital records simplify audits and reduce the risk of penalties during roadside inspections.

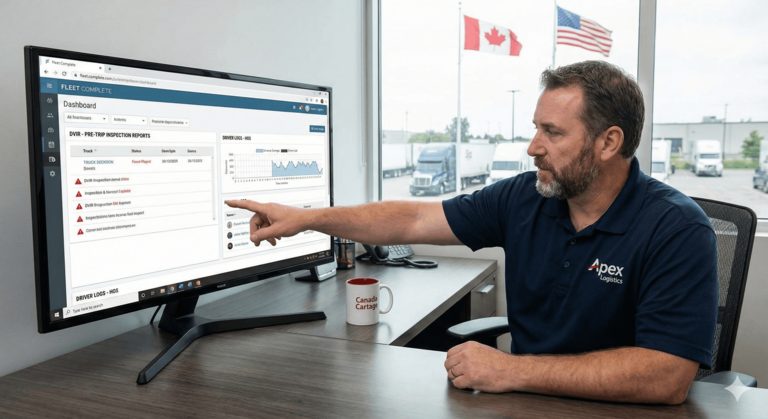

How DVIR Software Enhances Driver Log Books

Modern DVIR software connects inspections, maintenance, and driver logs into one system. This allows fleets to:

- Automatically record inspection results

- Track defects and repairs

- Link logs to vehicles and drivers

- Generate compliance reports instantly

This integration reduces paperwork and increases accountability across the fleet.

Why Fleets Are Moving to Digital Log Books

Fleets are adopting digital driver log books because they:

- Reduce administrative workload

- Improve data accuracy

- Prevent compliance gaps

- Support scalability as fleets grow

Digital systems also provide insights that help reduce costs and improve vehicle uptime.

Frequently Asked Questions (FAQ)

What is a driver log book used for?

A driver log book records driving activity, inspections, expenses, and maintenance to ensure regulatory compliance and vehicle safety.

Are driver log books required by law?

Yes. Commercial drivers in the US and Canada must maintain records demonstrating compliance with transportation regulations.

Can driver log books be digital?

Yes. Digital driver log books are widely accepted and often preferred due to accuracy and audit readiness.

How do driver log books help with inspections?

They provide documented proof of inspections, maintenance, and compliance during roadside checks or audits.

Do driver log books replace DVIR reports?

No. Driver log books and DVIRs serve different purposes but work best when integrated into one system.

Final Thoughts

Driver log books are essential tools for tracking expenses, managing maintenance records, and ensuring compliance. By moving to digital solutions and integrating with DVIR software, fleets can improve accuracy, reduce administrative burden, and maintain better visibility into operations.

For more information about digital DVIR solutions, read our guides: Electronic DVIR Guide: Switch from Paper to Digital and Why Drivers Skip Pre-Trips (And How to Fix It).